An Exceptional Education Within Reach

At Kent School, we understand that affordability plays a significant role in your decision-making process. That’s why we’re committed to providing transparent tuition information and personalized support throughout the financial aid process.

Tuition for 2025-2026

Our inclusive tuition covers academic programming, classroom materials, and school-sponsored trips.

Little School (Ages 3–5)

- Four days per week: $9,700

- Five days per week: $10,700

Kindergarten: $14,950

Grades 1–4: $19,300

Grades 5–8: $20,650

Making Kent School Affordable

Over 40% of our families receive tuition assistance. Our goal is to partner with you to make a Kent School education accessible.

We offer:

- Flexible payment plans (monthly, semi-annual, or single payment)

- Personalized, need-based tuition assistance through Clarity

- Sibling Loyalty Discount (for families with 3+ enrolled students)

For 2024–2025, families receiving aid typically paid:

- Kindergarten–Grade 4: $8,100 – $17,300

- Grades 5–8: $8,690 – $18,500

Every family’s financial situation is different. We encourage all families to explore what’s possible.

Not Sure Where to Start? Let’s Talk.

You do not need to complete a Clarity application before speaking with us.

We’re happy to connect and talk through:

- How tuition assistance works

- What Clarity will ask for

- Whether your family might qualify

Reach out at any point — we’re here to support you.

Or call (410) 778-4100 to speak with our admissions team.

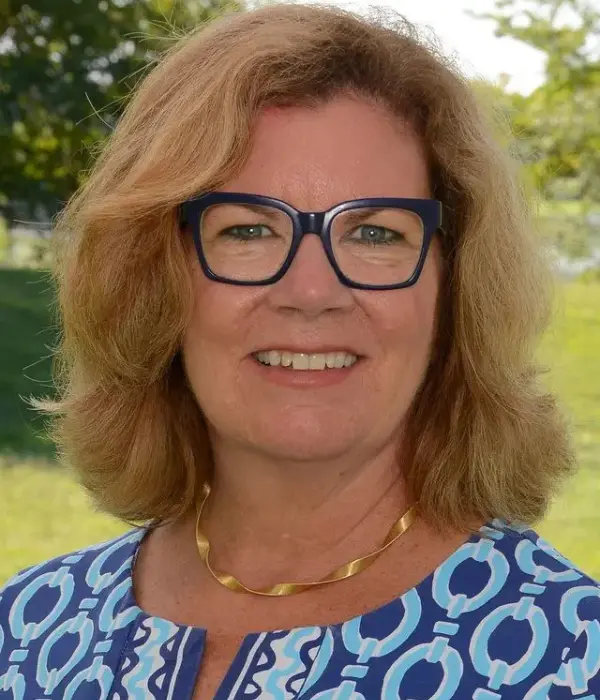

Meet Your Admissions Contact

Tricia Cammerzell

Assistant Head of School for Advancement

[email protected]

(410) 778-4100

Whether you have questions about tuition, assistance, or the admissions process, Tricia is happy to help and looks forward to connecting with your family!

How to Apply for Tuition Assistance

If you’re ready to begin the financial aid process:

- Visit Clarity Tuition and create your account

- Submit your family’s financial profile

- Receive a personalized tuition assessment from Kent School

Returning families must apply annually to reflect updated needs.

Little School Tuition & Tax Benefits

While tuition assistance is not available for Little School, your tuition may qualify for federal tax benefits under dependent care credits. Please consult your tax advisor for details.

Let’s Talk About What’s Possible

Every family is different. Whether you’re just exploring or ready to apply, we’re here to guide you with honesty and care.